idaho military retirement taxes

Overview of Idaho Retirement Tax Friendliness. When stationed outside the State of Idaho active duty personnel are exempt from Idaho state income tax.

Idaho National Guard Retirees Military Division

Idaho - Tax-free for retirees 65 and older or disabled retirees 62 or older.

. Learn more about Idaho Retirement Benefits Deduction for Military Retired Pay. Idaho State Taxes on Military Disability Retirement Pay. Find Idaho state and local veterans benefits including education employment healthcare tax breaksexemptions.

Military Disability Retirement Pay. Recipients must be at least age 65 or be. Idaho residents must pay tax on their total income including income.

A Military retirement b Civil Service Retirement System CSRS if the account number begins with 0123. Additionally the states property and sales taxes are relatively low. To a veteran or the unremarried.

Social Security retirement benefits are not taxed at the state level in Idaho. If you are a nonresident of Idaho stationed in Idaho if your military home of record isnt Idaho and you were on active duty stationed in Idaho for all or part of the year Idaho doesnt tax your. However according to Idaho instructions Idaho allows for a.

Idaho Veteran Benefits for Retired Military Pay Income Tax Deduction Idaho veteran benefits provide that retirement payments by the US. This guide lists some resources that can be useful to Idaho senior citizens and retirees. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income.

State Income Tax Exemption. State Income Tax Retired Military Pay. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return.

Kentucky - Up to 31110 is tax-free you may be able to exclude more in some situations. The retirement annuities eligible for this deduction on the Idaho State return include.

Idaho State Veteran S Benefits 2021 Veterans Resources

Idaho Will Become 10th Individual Flat Tax State In 2023 Don T Mess With Taxes

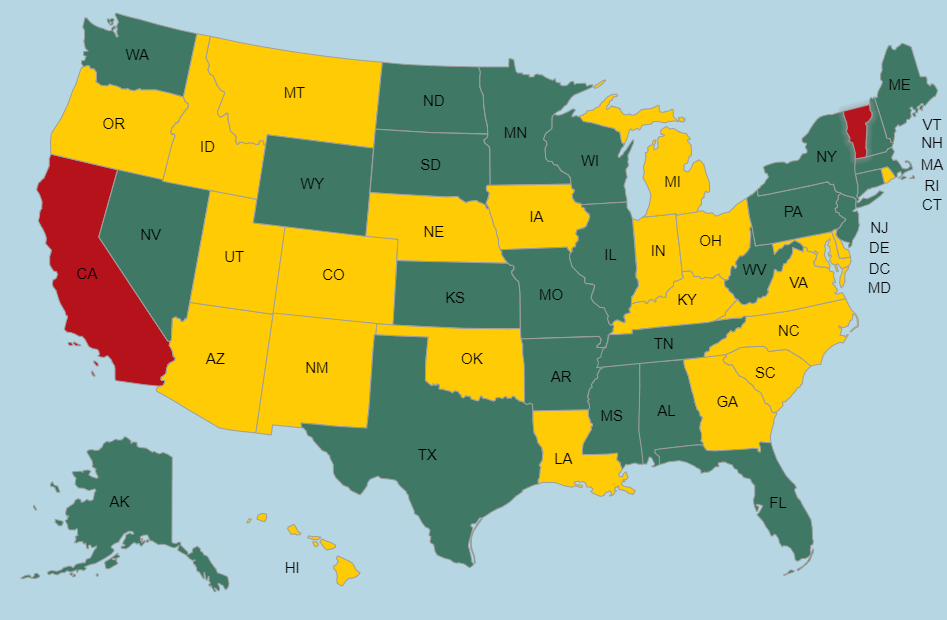

States That Don T Tax Military Retirement Pay Discover Here

Retiring These States Won T Tax Your Distributions

Nebraska Taxation Of Military Retirement Pay Lutz Accounting Blog

Moaa Moaa S Military State Report Card And Tax Guide

Military Retirement And State Income Tax Military Com

States That Won T Tax Your Federal Retirement Income Government Executive

The 10 Least Tax Friendly States For Military Retirees Kiplinger

Double Bonus Military Retirees Can Receive Retirement And Va Disability Benefits Hill Ponton P A

Official Website Of Valley County Idaho Property Tax Relief

Idaho Military And Veterans Benefits The Official Army Benefits Website

Six Things About Military Retirement Pay Military Com

Find Out If You Qualify For City Of Mountain Home Idaho Facebook

Idaho National Guard Retirees Military Division

Wait Is Military Retirement Pay Taxable Or Not Article The United States Army

The Top 12 Idaho Veteran Benefits For 2022 Va Claims Insider

States That Don T Tax Military Retirement American Dream U

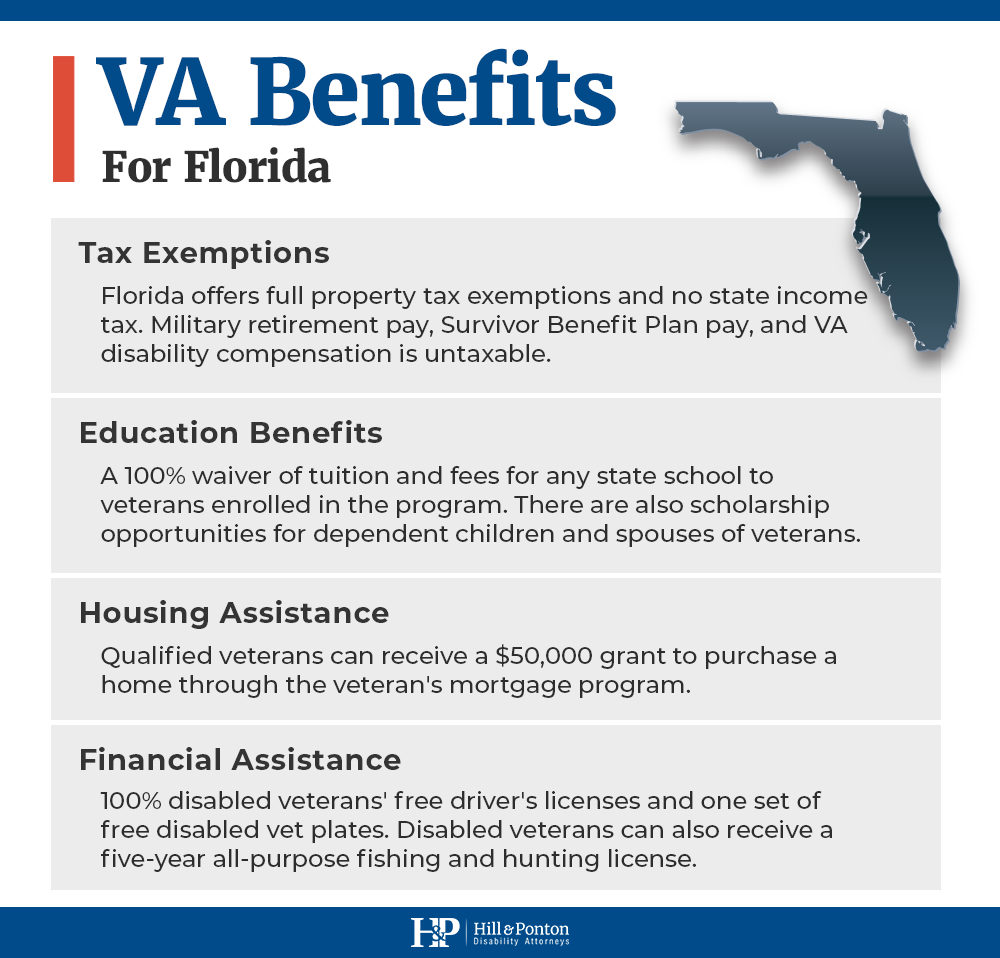

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A