arizona charitable tax credits 2020

When you make a donation to St. This credit is limited to the amount of tax calculated on your Arizona return.

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

10 rows ADOR will be sending renewal letters to filers to renew their 2023 Arizona Transaction Privilege Tax License.

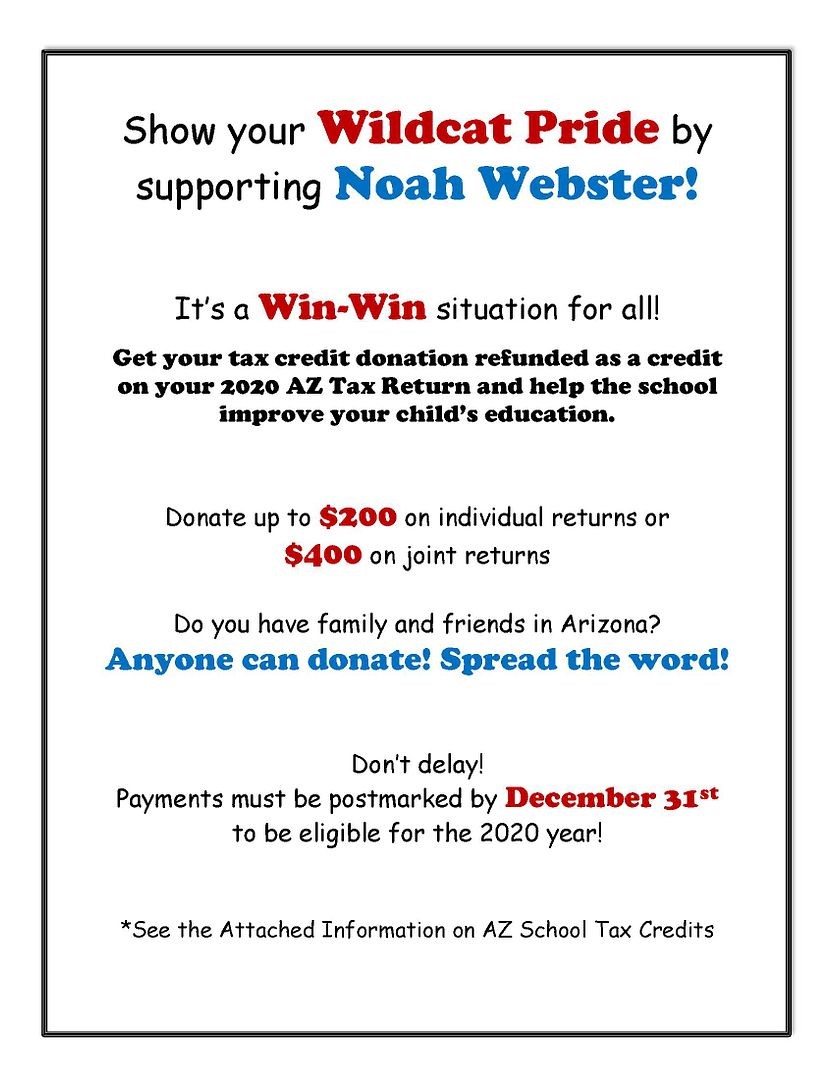

. The maximum contribution allowed is 800 for married filing joint filers and 400 for single heads of household. 2020 limits are quoted. Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400 individually or 800 for couples filing jointly.

Care charitable organization QFCO see credit Form 352. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing. AZ Tax Credit Funds - Start the Process.

Marys Food Bank you can receive a dollar-for-dollar tax credit on your AZ state return up to 400 for individuals and 800 for those filing. Phoenix Rescue Mission will provide you with a year-end giving summary by April 15 2022. The lists of the certified charities on azdorgov displays the certified charities for that year.

And many online services allow you to complete this form digitally while doing your taxes To give. Due to the COVID-19 outbreak the deadline for filing and paying State and Federal income tax has been extended from April 15th 2020 until July 15th 2020. Couples who file jointly.

Just make sure to your contribution to RMHCCNAZ up until. This change is in effect until June 30 2022. SCNM Sage Foundation is a Qualified.

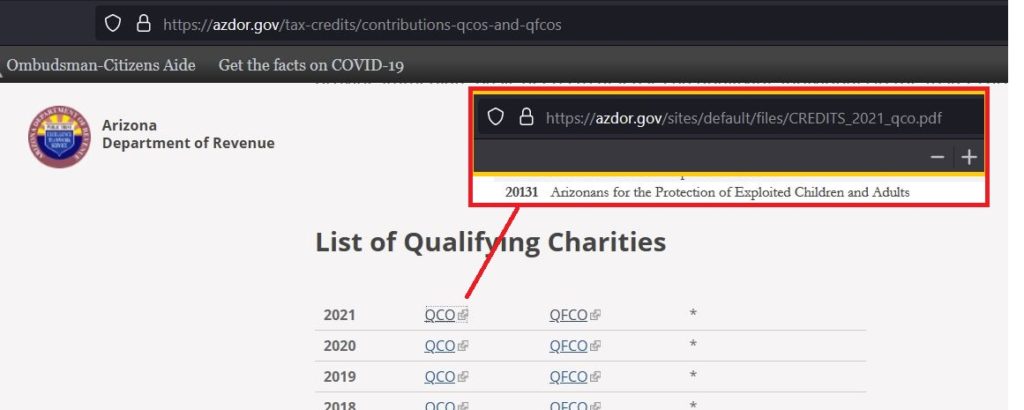

A taxpayer can only claim a tax credit for donations made to certified charities. Below youll find links to information and donation pages for six different AZ eligible tax credit options. We are a qualified charitable organization for this credit.

2023 Transaction Privilege Tax License Renewals are Coming. You may receive a dollar-for-dollar tax credit for contributions to the following types of charitable organizations. Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in.

If you donate to The Salvation Army in Arizona by Tax Day 2020 you can claim a tax credit for 2019 that reduces dollar for dollar what you pay in state income tax. ADOR will be sending renewal letters to filers to renew their 2023 Arizona Transaction Privilege Tax License. Arizona Credit for Donations Made to.

Individuals may give up to 400 couples can. Make a donation to the National Kidney Foundation of Arizona by April 15th 2021.

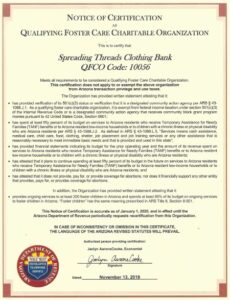

Arizona Foster Care Tax Credit Hope A Future

Arizona State Tax Credit Esperanca

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Az Charitable Tax Credit Foster Care And Charitable Tax Credit

Arizona Tax Credit A Win Win For All

Tax Information Spreading Threads

Arizona Tax Credit Donation Info Valley Academy

Charitable Tax Deductions By State Tax Foundation

Home Prescott Area Tax Credit Coalition

Arizona Tax Credits To Christian Organizations Charitable And Foster Care

Az Charitable Tax Credit Foster Care And Charitable Tax Credit

Arizona Tax Planning 529 Plans And Charitable Donation Credits Henry Horne

Arizona Tax Credits Millions Go To Foster Care Program Who Benefits